Retro Çiçek Uzun Etek kadın Zarif plaj elbisesi İçi boş Bölünmüş Rahat Uzun Kollu Peri Parti Etek Tatil satış > Kadın Giyim \ Pacacisemsi.com.tr

Deniz dünyası denizyıldızı desenli elbise kadın moda yaz kayışı plaj elbisesi bohem kolsuz parti elbiseleri zarif Sundress etek etek - AliExpress

Lazz1on Kadın Kaftan Plaj Elbisesi Pareo Çiçek Desenli Kimono Maxi Uzun Elbise Tunik Etnik Maksi Elbise Bikini Örtüleri : Amazon.com.tr: Moda

Büyük Beden Plaj Elbisesi Kadın Plaj Giyim Örtüler Uzun Beyaz Tunik Bikini Mayo Örtü Banyo Elbisesi Sarong Plage Pareo #q1001 | Fruugo TR

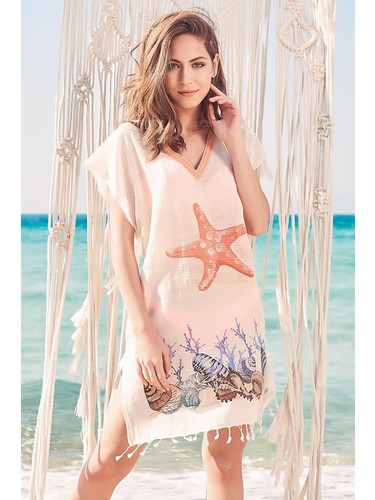

Jecarden Kadın plaj elbisesi, bikini örtüsü, kadınlar için, büyük beden, plaj pançosu, bol, yazlık elbise, kadın, şık, maksi elbise, pamuk, tatil için, tek beden, #18, E : Amazon.com.tr: Moda

Satın alın Large Size Loose Dress Women's Seaside Holiday Wind Slit Super Fairy Print Beach Dress | Joom

Genel Markalar Ip Askılı V Yaka Kolsuz Ajurlu Dantel Detaylı Fileli Motifli Çift Yırtmaçlı Beyaz Plaj Elbisesi Bluz Fiyatı, Yorumları - Trendyol