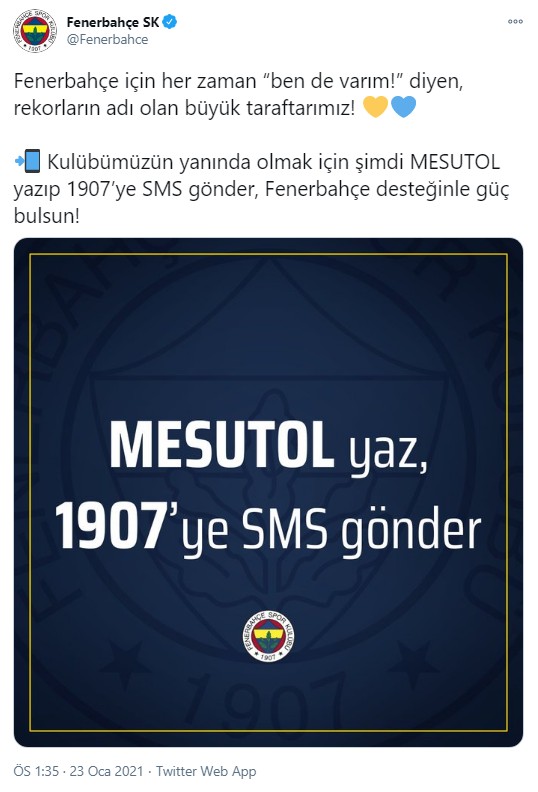

KULÜBÜMÜZE DESTEK OLMANIN ŞİMDİ TAM ZAMANI! “Fener Ol” yaz, 1907'ye gönder. #FenerbahceMESUToluyor @Fenerbahce | Instagram

Fenerbahçe - Her zaman Çubuklu'nun yanındayız. 💛💙 📲 Geleceğimiz için şimdi sen de "Fener ol" yaz 1907'ye SMS gönder. 🔗 https://www.fenerbahce .org/fenerol | Facebook

Genç Fenerbahçeliler - Fenerbahçemizin geleceğine FENER OL! 👉 FB yaz 1907'e Gönder. 👉 yuklen.in 👉 https://www.fenerbahce.org/taraftar/destek/kredi-karti-ile-odeme | Facebook

Genç Fenerbahçeliler - Fenerbahçemizin geleceğine FENER olmaya devam ediyoruz. FB yaz 1907'ye yolla sende Fener Ol! #WinWin | Facebook

2015-16 Sezonu Çubuklu Forma (Maç Versiyonu)... 2015-16' Home Jersey... # Fenerbahçe #2015 #2016 #fenerol #1907 #fb #forma #koleksiyo... | Instagram

Fenerbahçe - 1-13 Ekim GİSBİR Boat Show Deniz Fuarı'nda FenerOl'uyoruz! 🔗 http://bit.ly/2nCbQq5 | Facebook

Başkan Vekilimiz Semih Özsoy, Zeljko Obradovic ve Melih Mahmutoğlu'nun # FENEROL Kampanya Konuşması - YouTube