Nirvana Enerji, 04-11-40 Nolu Sınıflardan Tescilli Marka ve Logo - Satılık Marka İlanları sahibinden.com'da - 1130880011

Luxurys Marka Tasarımcısı Moda Telefon Kılıfları İPhone 13 12 Mini 11 Pro MAX XR XS 7 8 Plus F Lüks Telefon Kapağı Takılı Kılıf Yi TL455.75 | DHgate

Yeni lüks kişilik trend marka telefon kılıfları apple i̇phone 11 12 pro 13 14 pro max şok geçirmez kapak funda çapa vaka indirim < Cep Telefonu Aksesuarları \ www.sekerciahmetefendi.com.tr

İndirim Komik moda marka spor ayı telefon kapak iphone 11 12 13 14 pro max 13mini 14 artı lüks siyah temperli cam tampon durumda \ Cep Telefonu Aksesuarları > Smartapps.com.tr

Devineresse Sıcak Kapalı Işıklı Gece Lambası Spor Ayakkabıları Marka Telefon Kılıfı iPhone 14 13 12 11 Pro Max Plus Telefon Kılıfı ins Yumuşak TPU Kapak - Sarı 12 için : Amazon.com.tr: Elektronik

İndirim Komik moda marka spor ayı telefon kapak iphone 11 12 13 14 pro max 13mini 14 artı lüks siyah temperli cam tampon durumda \ Cep Telefonu Aksesuarları > Smartapps.com.tr

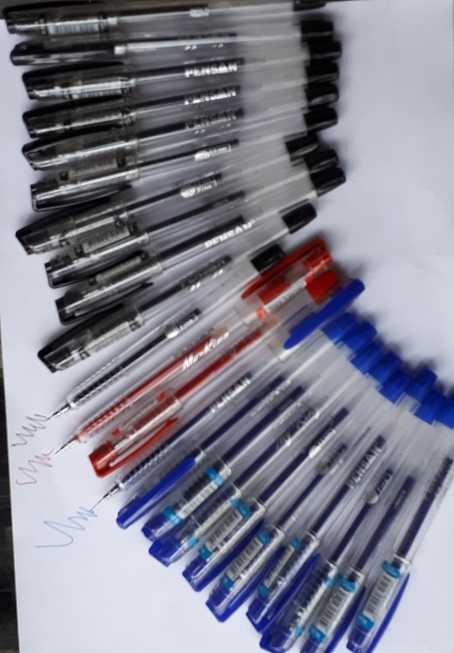

Tükenmez Jel Kalem 0.5 mm 25 Adetli pk (12 Mavi +11 Siyah+2 Kırmızı)PENSAN Marka My King Seri - Antika ve Koleksiyon - kitantik | #13062311000197

Apple Iphone 11 Pro Için Karl Lagerfeld Marka Yüzen Parilti Ve Marka Sembollü Sıvı Akışkanlı Kılıf, Altın | The Kase Istanbul

11 Derece Erkek 11d Core Eşofman Altı Standart Kesim Lacivert, lacivert mavi, L : Amazon.com.tr: Moda

Moda Marka Ayı Telefon Kılıfı İçin iphone 11 12 13 14 Pro Max Mini X XR Xs Max 7 8 14 Artı Lüks Sert PC Koruma tampon Durumda satış > Cep Telefonu Aksesuarları \ Pacacisemsi.com.tr