บุญถาวร Boonthavorn - โคมไฟผนังภายใน MAX LIGHT รุ่น WU20520-1 รหัสสินค้า:1163478 ยี่ห้อ:MAX LIGHT สี:ดำ https://bit.ly/3gOcfy0 | Facebook

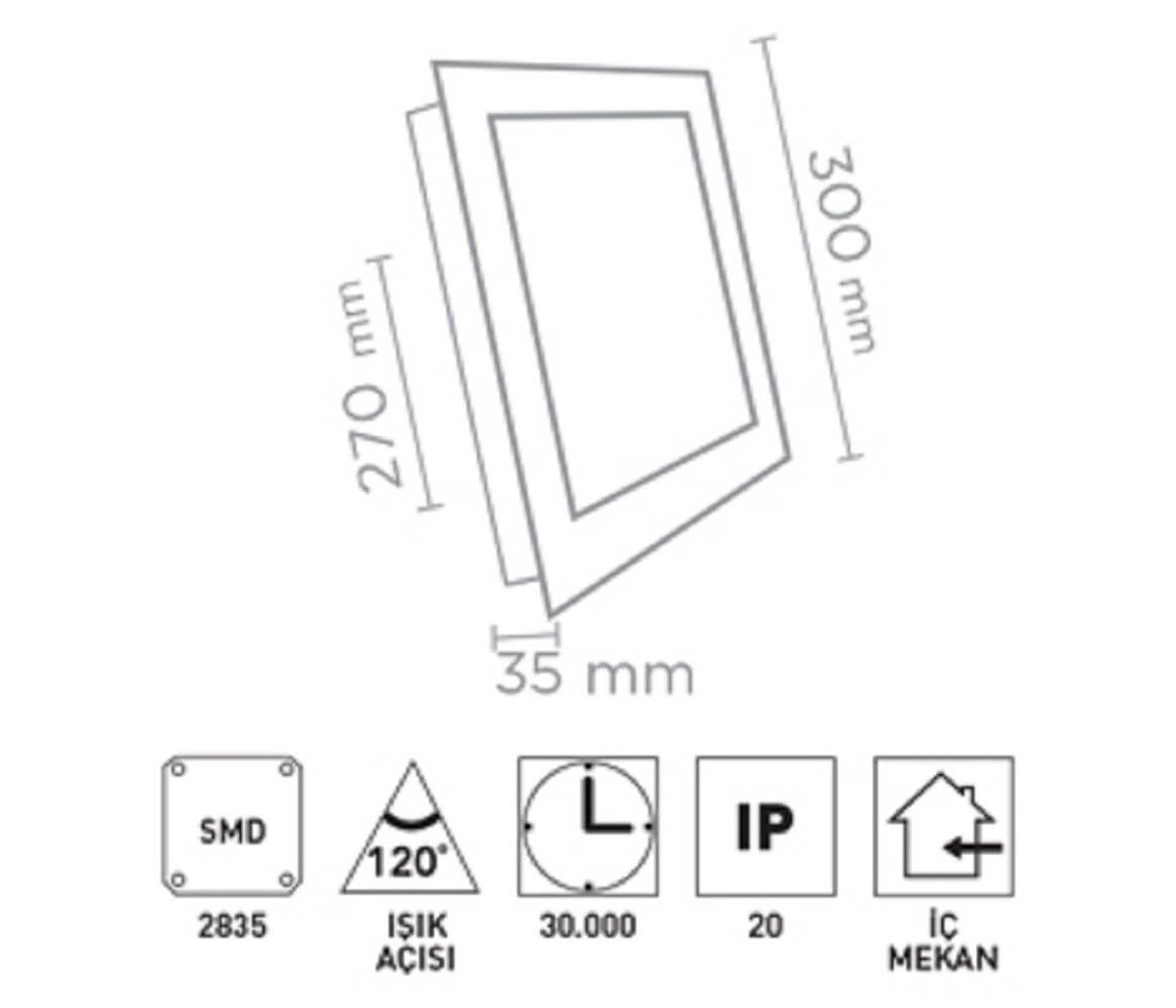

MAX LED PANEL LIGHT 20W - 800buildingmaterials Dubai UAE Abu Dhabi Riyadh Jeddah Dammam Muscat Oman Sohar Salah